The internet has fundamentally changed how we live, work, and connect. Now, we are standing at the threshold of its next evolution: Web3. You've likely heard this term mentioned alongside "blockchain," "crypto," and "decentralization," but what exactly is it? Web3 represents the next generation of the internet, built upon the powerful principles of user ownership, transparency, and decentralized control. This is far more than a simple technical update; it is a paradigm shift in how we manage digital assets, interact online, and build communities.

For everyone in the dynamic Vietnamese market, from crypto beginners to expert investors, understanding Web3 is essential. This new digital frontier presents unprecedented opportunities for financial growth, innovation, and direct participation in a global, decentralized economy. This guide will provide a comprehensive overview, covering everything from the foundational concepts to advanced strategies for leveraging this technology. We will explore how Web3 works, its core components, and how you can start your journey safely and effectively.

The Evolution of the Internet: From Web1 to Web3

To fully appreciate the significance of Web3, it is crucial to understand its predecessors. The internet's development can be seen in three distinct phases, each defined by its unique capabilities and limitations.

Web1: The "Read-Only" Internet (Circa 1991-2004)

Think of Web1 as a vast, digital encyclopedia. It was a static, "read-only" network where most users were passive consumers of information. Websites were built using basic HTML and served content directly from static files. Interaction was minimal; you could read articles and browse directories, but you couldn't contribute your own content.

- Key Characteristics: Static pages, one-way information flow, and content created by a small number of developers.

- Analogy: A digital newspaper. You can read it, but you cannot write comments or submit your own articles.

- Limitation: The creation of content was centralized, and there was no room for user interaction. Power resided with the few who had the technical skills to build and host a website.

Web2: The "Read-Write" Internet (Circa 2004-2020)

Web2, also known as the "social web," brought about a revolution in interactivity. Users could now not only consume content but also create and share it with a global audience. The rise of social media platforms like Facebook and YouTube, e-commerce giants like Amazon, and countless blogs defined this era.

This leap forward was fueled by advancements in web technologies like JavaScript and sophisticated server-side programming. The internet transformed from a collection of static pages into a platform for dynamic applications.

- Key Characteristics: User-generated content, social connectivity, and the emergence of massive technology platforms.

- Analogy: A bustling global marketplace where anyone can set up a stall, share their ideas, and interact with others.

- Limitation: While users generated the value, large corporations owned the platforms. This created a new form of centralization. These companies control user data, set the platform rules, and monetize the content you create. Your digital identity and assets are locked within their closed ecosystems.

Web3: The "Read-Write-Own" Internet (The Present and Future)

This brings us to Web3, the "decentralized web." Its core mission is to add a critical third layer to the interactive nature of Web2: ownership. Instead of platforms being owned and operated by corporations, Web3 is built on decentralized networks, primarily blockchains.

In this new model, users can own a piece of the internet themselves. This ownership is realized through digital assets like cryptocurrencies and Non-Fungible Tokens (NFTs). Your data is yours to control, your digital assets are verifiably yours, and you can move them across different applications without needing permission from a central gatekeeper.

- Key Characteristics: Decentralization, blockchain technology, true user ownership, and a token-based economy.

- Analogy: A digital cooperative where the users are also the owners. They have a direct stake in the network's success, can vote on its governance, and share in the value created.

- Vision: To build a more equitable, transparent, and user-centric internet.

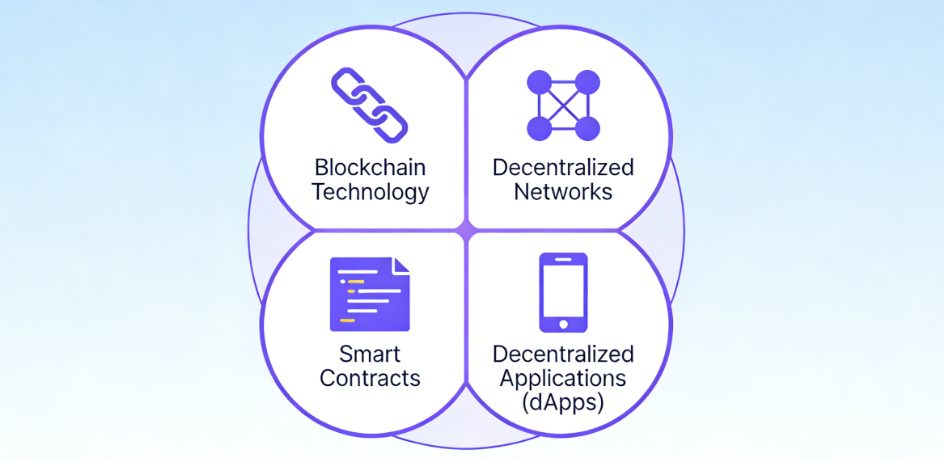

What is Web3? An Explanation of its Core Pillars

Web3 is not a single piece of technology but rather a stack of technologies and philosophies working in concert. To truly understand its potential, we must examine its foundational pillars.

1. Blockchain and Distributed Ledger Technology (DLT)

Blockchain is the engine that powers Web3. It is a shared, immutable digital ledger that records transactions and tracks assets across a network. Imagine a digital record book that is copied and distributed across thousands of computers worldwide, with no single entity in control.

- Decentralized: Instead of a central party like a bank controlling the ledger, every participant in the network holds a copy. This eliminates the need for trusted intermediaries.

- Transparent: Most public blockchains, such as Bitcoin and Ethereum, allow anyone to view the entire history of transactions. This introduces a radical level of transparency.

- Immutable: Once a transaction is confirmed and added to the blockchain, it is cryptographically sealed and cannot be altered or deleted. This makes the ledger incredibly secure and tamper-proof.

This technology is the bedrock of Web3 because it enables "trustless" interactions. You don't need to trust the person or company you are transacting with; you only need to trust the transparent and verifiable code of the network.

2. Decentralization: Shifting Power to the Users

Decentralization is the guiding principle of Web3. In the Web2 model, power and data are consolidated in the hands of a few large tech companies. They act as gatekeepers, controlling access and dictating the terms of participation.

Web3 aims to dismantle this centralized structure. By building applications (known as "dApps") on decentralized blockchain networks, services can operate without a central point of control or failure. This has several profound implications:

- Censorship Resistance: Without a central authority, it is extremely difficult for any single entity, be it a company or a government, to shut down a service or remove content.

- Disintermediation: Many services today rely on middlemen who take a percentage of every transaction. Web3 facilitates direct peer-to-peer interactions, making services more efficient and affordable.

- User Governance: Many Web3 projects are governed by their users through Decentralized Autonomous Organizations (DAOs). Holders of the project's governance token can vote on proposals and collectively shape the future of the protocol.

3. Cryptocurrencies and Tokenization

Cryptocurrencies are the native currencies of the Web3 ecosystem. These are digital tokens secured by cryptography. Unlike traditional currencies issued by governments (fiat), cryptocurrencies are typically decentralized and operate on a global scale.

- Function: Cryptocurrencies fulfill multiple roles. They can be a medium of exchange (like Bitcoin), a utility token to pay for services on a network (like Ether on Ethereum), or a governance token granting voting rights in a DAO.

- Tokenization: This is the process of converting rights to an asset into a digital token on a blockchain. Nearly anything can be tokenized: real estate, fine art, a share in a company, or even intellectual property. This unlocks liquidity and enables fractional ownership of previously illiquid assets. For users in Vietnam, platforms like HIBT offer a secure and efficient gateway to this new world of digital assets.

4. Smart Contracts: The Automated Logic of Web3

If blockchain is the infrastructure of Web3, smart contracts are the applications that run on top of it. A smart contract is a self-executing program where the terms of an agreement are written directly into code. These contracts run on the blockchain and automatically execute when specific, predetermined conditions are met.

- Automation: Smart contracts automate complex agreements and processes without requiring an intermediary. For example, a smart contract can automatically release payment to a freelancer once their work is approved or distribute an insurance payout immediately after a verified event occurs.

- Trustless Execution: Because they are deployed on the blockchain, smart contracts are tamper-proof and their execution is guaranteed by the network. You don't need to trust the other party to honor the agreement; you only need to trust the code.

- Applications: Smart contracts are the building blocks for nearly all Web3 applications, including Decentralized Finance (DeFi), NFTs, and DAOs.

A How-To Guide: Web3 for Beginners in Vietnam

For newcomers, the world of Web3 can seem complex. However, getting started is more straightforward than you might think. Follow this step-by-step guide to begin your journey.

Step 1: Get a Crypto Wallet

Your wallet is your passport to the Web3 world. It is a digital application that allows you to store, send, and receive your digital assets and interact with dApps. Your wallet holds your "private keys"—the cryptographic passwords that prove you own your assets. It is critical to understand that you are your own bank. If you lose your private keys, you lose access to your funds forever.

- Types of Wallets:

- Software Wallets (Hot Wallets): These are applications you can install on your phone or as a browser extension (e.g., MetaMask). They are convenient for frequent use but are connected to the internet, making them more vulnerable to hacking.

- Hardware Wallets (Cold Wallets): These are physical devices (e.g., Ledger) that store your keys offline. They offer the highest level of security and are ideal for storing significant amounts of assets long-term.

For beginners, starting with a reputable software wallet is a great first step to learn the basics.

Step 2: Acquire Cryptocurrency

Once you have a wallet, you need to fund it. The easiest way for users in Vietnam to do this is through a trusted centralized exchange (CEX). These platforms act as a bridge between the traditional financial system (VND) and the crypto economy.

Sign up for a reliable exchange, complete the necessary identity verification (KYC), and you can purchase major cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) using a bank transfer. From the exchange, you can then withdraw your crypto to your personal wallet to begin interacting with Web3.

Step 3: Explore Web3 Applications (dApps)

With a funded wallet, you can now explore the decentralized internet. Here are a few areas to start your exploration:

- Decentralized Exchanges (DEXs): Platforms like Uniswap allow you to swap one cryptocurrency for another directly from your wallet, without an intermediary.

- NFT Marketplaces: Browse digital art and collectibles on platforms like OpenSea.

- Blockchain Games (GameFi): Play games where you can earn crypto rewards and truly own your in-game items as NFTs.

Start small. Use a small amount of funds to experiment and understand how transactions work before committing larger sums.

Web3 Cryptocurrency Guide for Experts: How to Invest Safely

For seasoned investors, Web3 presents a new asset class with asymmetric upside potential. However, high returns are accompanied by high risks. A sophisticated approach is necessary to navigate this volatile market.

Advanced Investment Strategies

Beyond simply buying and holding major assets, experienced investors should look deeper into the ecosystem to identify emerging trends and technologies.

1. Layer-1 and Layer-2 Protocol Investing

- Layer-1s (L1s): These are the foundational blockchains, such as Ethereum and Solana. Investing in an L1's native token is a bet on the growth and adoption of its entire ecosystem. When evaluating L1s, analyze metrics like transaction speed (TPS), transaction fees, decentralization, and the strength of its developer community.

- Layer-2s (L2s): These are scaling solutions built on top of L1s to improve their performance and reduce costs, such as Polygon and Arbitrum. As L1s like Ethereum face congestion, L2s are positioned for significant growth. Investing in L2s is a bet on the scaling of Web3.

Case Study: The Rise of Layer-2s

In 2022 and 2023, Ethereum's high transaction fees made it unusable for many everyday applications. Layer-2 solutions like Arbitrum and Optimism emerged, offering a nearly identical user experience but with fees that were 10-100x cheaper. This led to a massive migration of users and capital to these networks. Investors who identified the "L2 scaling" narrative early and invested in these ecosystems saw substantial returns, illustrating the value of understanding the technical needs of the market.

2. Identifying Market Narratives

The crypto market is heavily driven by narratives—overarching themes that capture the collective attention of investors. Identifying these narratives early is a key to successful investing. Past examples include:

- DeFi Summer (2020): A surge of innovation and investment in decentralized finance protocols.

- The NFT Boom (2021): The explosion of digital art and profile-picture collections into the mainstream.

- Real-World Assets (RWA) (2023-2024): The trend of tokenizing physical assets like real estate and private credit on the blockchain.

Staying informed through crypto research platforms, social media (especially X/Twitter), and community forums is crucial for spotting these trends before they become widely known.

Risk Management: How to Invest in Web3 Safely

The potential for high rewards in Web3 is matched by its significant risks. Effective risk management is not optional.

- Diversification: Do not concentrate your capital in a single project. Diversify across different sectors (L1s, DeFi, GameFi, Infrastructure) and assets.

- Security Audits: Before interacting with a new DeFi protocol, verify that it has been audited by one or more reputable security firms. Audits help identify vulnerabilities in smart contracts.

- Due Diligence: Never invest based on hype. Research the project's team, its value proposition, its tokenomics, and its roadmap.

- Position Sizing: Allocate only a small portion of your total portfolio to highly speculative Web3 investments. Use established assets like BTC and ETH as your foundation.

- Use Secure Platforms: For your trading activities, rely on established and secure platforms. A professional exchange like HIBT provides advanced tools and robust security, ensuring your assets are protected while you engage with the market.

The Future of Web3: What Lies Ahead?

Web3 is still in its early stages, and its full potential has only just begun to be explored. Several key trends are set to define its future.

1. Mass Adoption and Improved User Experience (UX)

Currently, one of the biggest barriers to Web3 adoption is its often-clunky user experience. Managing private keys and paying for transaction "gas" fees can be intimidating for non-technical users. The next wave of innovation is focused on abstraction—hiding the complexity of the blockchain. Expect to see dApps that feel as seamless as Web2 applications, with simplified onboarding and wallet management.

2. The Convergence of AI and Web3

The intersection of Artificial Intelligence and Web3 is a powerful combination. AI can be used to create more dynamic NFTs, manage DAOs more efficiently, and enhance network security by detecting threats in real-time. In turn, Web3 can provide transparent and verifiable data for training AI models and enable decentralized marketplaces for AI algorithms and services.

3. Regulation and Institutional Adoption

As the Web3 industry matures, clear regulatory frameworks will emerge. While some fear regulation, well-defined rules will bring legitimacy to the space and pave the way for institutional investors. The influx of institutional capital will provide greater market stability and fund the next generation of Web3 innovation.

Case Study: The Approval of Spot Bitcoin ETFs

In early 2024, the U.S. SEC approved several spot Bitcoin ETFs from major financial institutions, including BlackRock. This was a landmark moment, providing a regulated and familiar way for traditional investors to gain exposure to Bitcoin. The approval signaled growing mainstream acceptance and triggered a significant inflow of institutional capital, demonstrating how clear regulation can act as a powerful catalyst for market growth.

Conclusion: Start Your Journey into the Decentralized Future

Web3 is more than a technological shift; it is a movement towards a more open, user-owned, and equitable internet. It empowers individuals, unlocks new economic models, and challenges the centralized power structures of the old web. For the people of Vietnam, this represents a unique opportunity to be at the forefront of digital innovation and financial sovereignty.

Whether you are a beginner setting up your first wallet or an expert analyzing Layer-2 solutions, the path into Web3 is one of continuous learning. Start by educating yourself, experiment with small amounts, and always prioritize security. Utilize trusted and reliable platforms to guide your trading activities. The decentralized future is being built today, and you can be a part of it. Seize the opportunity to learn, invest, and build on this new frontier with the confidence that comes from using a secure and professional platform like HIBT.

Author: Dr. Minh Pham

Dr. Minh Pham is a leading authority in distributed systems and cryptographic security. He has authored over 20 peer-reviewed papers on blockchain consensus mechanisms and zero-knowledge proofs. Dr. Pham has also led the security audits for several prominent DeFi and Layer-1 blockchain projects, ensuring the integrity of billions of dollars in user assets.